Business

Understanding the Fundamentals of Construction Project Estimation

Construction cost estimating plays a key role in any project to run at a profit and not incur financial losses. The pricing estimates become necessary for bidders (contractors) as well as owners (owners) who want to stay within the budget, therefore, budgeting. Not knowing all the factors that can influence the development of construction estimates, can lead to inaccurate budgets and bids. Without a good understanding of what goes into preparing budgets, we might have to delay projects, reduce the profit margin, or lower the cash flow. Here, we will work on the key fundamentals that make up the estimates.

Gather Complete Project Details

The first thing to do in estimating is to collect all the information regarding the extent of the project and the specs that exact it. This includes things like:

- The design considerations, the land parcel, and the construction type.

- Site address and properties (landforms, terrain, waterway, etc.)

- List of all needed items, such as steel, concrete, finishes, etc.

- Expose construction drawings and plans as a set of drawings

- The expectations for projects as far as their schedules and duration are concerned

- Zoning, codes, regulations, and many other aspects will be central to the gravity of the issue.

An estimator can’t do their job without having this information complete and accurate in front of them; otherwise, the projection will be completely wrong data. Amongst key statistics, such as the whole floor area, the amount of concrete that will be used for construction, is considered more significant. The higher the level of initial clarity, the tighter the estimate’s precision.

Define the Estimating Metrics

First of all, commercial construction estimating services specialists prepare for the takeoff. They contemplate what they will use as a basis for an estimate. For construction costs, usually, the estimates are categorized by type (such as materials, equipment, labor, subcontract work, etc.) and the location-specific factors involved. Such cost categories make the comparison of competitive bids on a common denomination possible and help to track actual costs against the estimated ones during the project execution, as well as to determine what most of the dollars are spent on.

Perform Detailed Quantity Takeoff

This phase comprises the most labor-intensive work: quantity takeoff is an estimate of the quantities of materials, work items, etc. needed for the work based on drawings and plans. What will be applied for the building is to study the drawings and the models to be able to determine volume like total cubic yards for foundations/floors, square feet required for drywall, the linear feet of ductwork and piping for HVAC per floor, etc.

The utilization of different software resources and digital procedures put the step in an efficient state. However, the estimator must have experience and utilize reference manuals, historical data about previous bids, unit cost guides, and so on. All these pieces of information help in giving a detailed takeoff sheet which indicates as many quantities as possible. At this step, accuracy is the most important, and in case of entirely wrong estimations, projections will be erroneous.

Find Out The Needs for Labor, Equipment, & Overhead

However, along with direct costs of materials and subcontractor quotations, all the crew labor for staging, hired equipment use rented facilities, and temporary installation structures bring in the whole project cost. These are essentially determined depending on estimated durable timeframes for each task, probable site conditions (weather, etc.) plus logistics and productivity assumptions. The construction firms also constantly inquire about a certain share of their Overheads which incorporate order management, estimate, and field team to each bid.

Establish Unit Pricing

They do this by utilizing historical bid data, component supplier prices, subcontractor bids, location-specific price guides as well as rate cards for the estimate of every element in the architectural drawing. By listing all these in a format like $X for one linear foot of piping, $X for every cubic foot of concrete, $X for every square foot of drywall supply and installation, and so forth. We also do a general lump sum allowance estimate. The levels of the metrics that have already been set such as labor hours, equipment rates, and overhead charges are also allotted per line item in this step.

Summarize for Bid Submission

The last consideration is the finalization of the takeoff quantities and pricing per the estimate breakdown structure which has been added to the overall construction estimating services NYC. Enforced by contingency allowance, which is an exceptional case when any cost overruns or unpredictable problems arise. The summarized budget develops a formal offer that is submitted to the client for final bidding. It is common for estimators to rebid and change their price target for the sake of budget adherence or winning bids with more competitive prices. Yet, the estimating process is not over after this as constant value engineering, subcontractor pricing buyout, quantity reconciliation during drywall takeoff services, and when the job is complete, the projections must be updated constantly, which makes the process less linear.

Conclusion

Summarizing, construct cost estimating combines the concepts of engineering, business knowledge, and analytical capacity. Calling upon the previous example, it is easy to imagine the huge importance of sophisticated professional savvy and responsibility that must be bared with throughout the process of taking what is often limited data at the bid stage and turning it into an accurate cost forecasting, while at the same time keeping in mind the profitability factor. Thus, picking out a seasoned at-risk cost cost-estimating partner turns out to be the most crucial element for any owner or contractor who yearns for unfailing budgets.

Business

Buying Guide for First-Time Buyers – Perfect Binding Machine

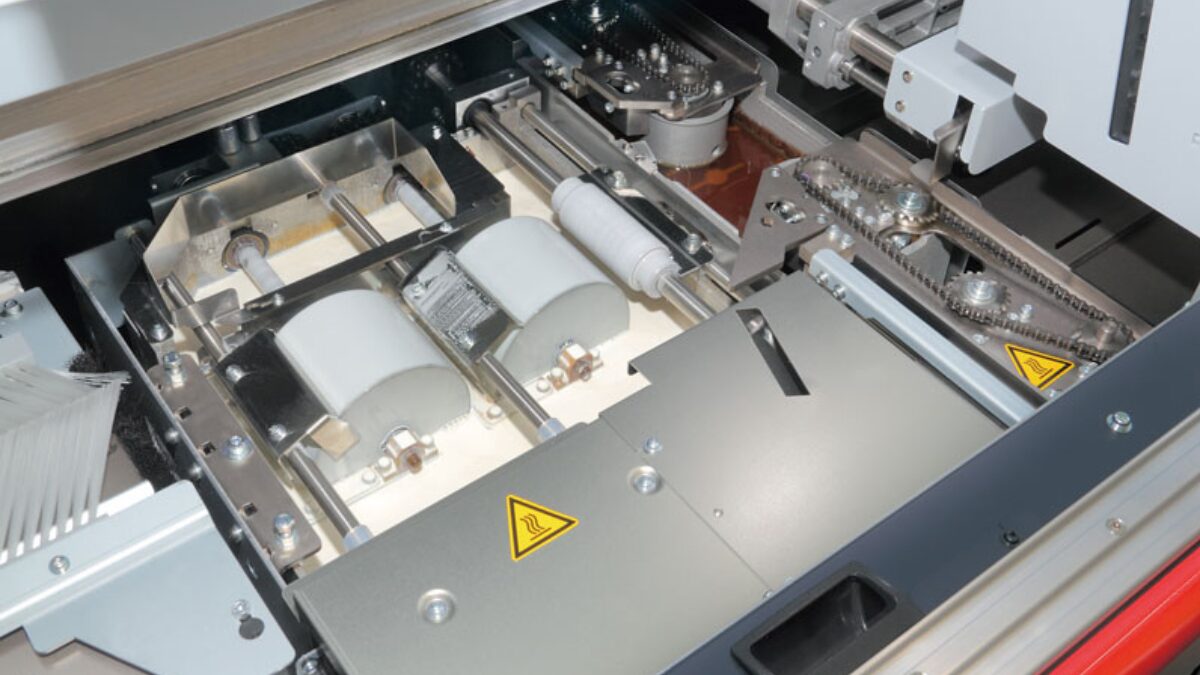

Purchasing the ideal binding machine can feel challenging, especially for first-time buyers. Binding is a widely used method in commercial and digital printing, where hotmelt adhesives are applied to combine loose pages and a cover. The result is a professional-looking book, magazine, or catalogue that is durable and aesthetically pleasing. This method is favoured for its ability to produce high-quality results at a relatively low cost, making it popular among printers of all sizes.

Perfect binding involves several critical steps, including firm clamping of the pages, precise spine preparation, applying adhesive, and nipping the cover into place. With various models and features available, it’s easy to feel overwhelmed. But don’t worry—this guide will walk you through everything you need to know to make an informed decision. Keep reading to learn more!

Key Features to Consider

When shopping for a perfect binding machine, there are several key features you’ll want to consider to ensure you get the right fit for your needs:

Capacity: Consider how many books or pages you’ll be binding regularly. Machines come in different capacities, and selecting one that matches your workload is essential.

Adhesive Type: Hotmelt adhesives are commonly used, but the specific type may vary based on your paper and desired durability. Ensure the machine supports the adhesives suited to your projects.

Speed: The speed of the machine can be a critical factor depending on the volume of work. Some machines are faster and more suited for high-volume operations, while others may be better for smaller, less frequent jobs.

Ease of Use: If you’re new to binding, a user-friendly machine with clear instructions and easy setup can save you much time and frustration.

Durability: Investing in a durable machine can save money in the long run, especially if you plan on using it regularly. Look for machines with robust clamping mechanisms and reliable cover-feeding systems.

Size and Space: Consider the physical space where you’ll place the machine. Some machines are compact, making them ideal for smaller workspaces, while others are larger and require more room.

Top Considerations for First-Time Buyers

As a first-time buyer, you’ll want to assess your specific needs. Here are some questions to help you choose your options:

- Kind of Project: If you’re primarily binding books, you may need a different machine than if you’re focusing on brochures or catalogues.

- Machine Usage: A more affordable, lower-capacity machine might be sufficient for occasional binding needs. However, investing in a more robust machine is advisable for daily or high-volume use.

- Your Budge: These machines range widely in price, so balancing cost with features is essential. While it might be tempting to go for the cheapest option, remember that a higher initial investment in a quality machine can pay off in long-term reliability and fewer repairs.

Common Mistakes to Avoid

It’s easy to make mistakes when purchasing your first paper binding machine. A common pitfall to look for is overlooking maintenance needs: Every machine requires maintenance; some are more demanding than others. Make sure you understand the maintenance requirements before purchasing.

Also, you shouldn’t focus solely on price while making your choice. While budget is important, focusing exclusively on the lowest price can lead to buying a machine that doesn’t meet your needs or lacks durability.

Future of Bookbinding: Key Trends

As you look toward the future of bookbinding, technological advancements continue to redefine the landscape. New developments include automated setups, advanced adhesive technologies, and digital and 3D printing integration. Sustainability is becoming a priority, shifting toward eco-friendly materials and adhesives.

The future of bookbinding machines will likely incorporate AI to enhance efficiency and minimise waste. Staying updated on these trends is crucial for making informed purchases. These innovations will help first-time buyers adapt to the changing landscape of book production.

Choosing a suitable machine is a significant investment, so it’s worth taking the time to make an informed decision. By understanding the basics of perfect binding and considering the key features, you’ll be better equipped to choose a machine that will meet your needs. Remember, your ideal machine should align with the projects you plan to tackle, the volume of work you anticipate, and your available budget.

Business

FintechZoom Best Forex Broker: A Comprehensive Guide to Choosing the Right Forex Broker in 2024

The world of forex trading can seem overwhelming, especially with the sheer number of brokers available today. However, finding the right forex broker is crucial for your trading success. Whether you’re a beginner or an experienced trader, the broker you choose plays a significant role in your ability to execute trades smoothly, access necessary tools, and ultimately make profits. That’s where FintechZoom comes into play. Known for its in-depth reviews and market insights, FintechZoom has become a trusted source for traders looking for the best forex brokers. In this article, we’ll explore the top forex brokers recommended by FintechZoom in 2024 and what makes them stand out.

What Makes a Great Forex Broker?

There are several factors that distinguish an average broker from a great one. When choosing a forex broker, it’s essential to consider the following:

Trustworthiness and Regulation

First and foremost, your broker should be regulated by a reputable financial authority. This ensures that your funds are protected and that the broker operates within a framework of strict standards. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) provide the oversight necessary to ensure that brokers remain transparent and fair.

User-Friendly Platform

A good trading platform is key to executing trades efficiently. Whether it’s MetaTrader 4, MetaTrader 5, or a proprietary platform, ease of use, reliability, and accessibility are essential. Advanced charting tools, real-time data, and a seamless mobile experience can make a significant difference.

Competitive Fees and Spreads

Forex brokers make money through spreads and commissions, so it’s important to find one that offers competitive rates. Low spreads and minimal hidden fees can dramatically reduce your trading costs over time, allowing you to keep more of your profits.

Customer Support and Service

Exceptional customer service is often overlooked but should never be underestimated. A responsive, knowledgeable, and accessible support team can assist with any issues that arise, ensuring your trades go smoothly.

How FintechZoom Evaluates Forex Brokers

FintechZoom has a reputation for providing unbiased and well-researched reviews. But how exactly do they determine which brokers deserve a spot on their coveted “Best Brokers” list?

Criteria Used for Evaluation

FintechZoom assesses brokers based on several criteria, including regulation, platform quality, fees, available assets, and user reviews. Brokers that offer fast execution, low fees, and robust customer support tend to rank higher.

Transparency in Ratings

One of the reasons traders trust FintechZoom’s recommendations is the transparency of their ratings. Their criteria are clearly defined, and they make use of both expert opinions and real user feedback to create a balanced and comprehensive picture of each broker.

Importance of User Reviews and Expert Insights

FintechZoom emphasizes community engagement by incorporating user experiences. This helps create a more accurate evaluation of brokers, allowing for a mix of expert insights and practical user feedback.

Top Forex Brokers According to FintechZoom in 2024

With numerous brokers out there, narrowing down the top choices can be difficult. According to FintechZoom, the following five brokers stood out in 2024.

Broker 1: IG Group

IG Group consistently ranks as one of the top forex brokers due to its extensive market access and stellar reputation. Regulated by top-tier financial authorities like the FCA, IG offers a highly intuitive platform with rich educational resources, making it suitable for traders of all levels.

- Pros: Excellent educational tools, advanced platform, strong regulation.

- Cons: High fees for small trades.

Broker 2: Saxo Bank

Saxo Bank is a premium broker that caters to serious traders. Offering a range of advanced tools and research materials, it’s perfect for those looking to trade a wide array of assets.

- Pros: Wide asset selection, excellent research tools.

- Cons: Higher minimum deposit requirements.

Broker 3: XM

XM is a well-regarded broker known for its competitive pricing and diverse account options. It offers both MetaTrader 4 and MetaTrader 5, giving traders flexibility in their trading tools.

- Pros: Tight spreads, no deposit fees, great for beginners.

- Cons: Limited product offering outside forex.

Broker 4: Pepperstone

Pepperstone has gained a strong reputation for offering ultra-low spreads and fast execution times. Its user-friendly platform and customer service are frequently praised by users, making it ideal for traders focused on efficiency.

- Pros: Fast trade execution, low spreads, excellent for scalping.

- Cons: Limited educational resources.

Broker 5: OANDA

OANDA is one of the most established brokers in the industry, known for its transparency and high-quality service. It offers flexible lot sizes and strong research tools, appealing to both beginners and experienced traders.

- Pros: No minimum deposit, strong analytical tools, flexible lot sizes.

- Cons: Limited asset classes outside of forex.

How to Choose the Right Broker for You

With so many excellent brokers to choose from, how do you know which one is right for you? Start by considering your trading style and risk tolerance. Are you a high-frequency trader? You might need a broker like Pepperstone with fast execution times. Are you just starting? XM or OANDA might be better, thanks to their user-friendly platforms and educational resources.

The Importance of Regulation in Forex Trading

It’s worth reiterating that regulation is critical in choosing a broker. Regulated brokers must follow strict rules that ensure your funds’ safety and transparent operations. Always check the regulatory status of a broker before signing up.

Understanding Forex Trading Fees

The fees charged by brokers can quickly eat into your profits if you’re not careful. Be sure to understand the difference between spreads, commissions, and overnight fees, and choose a broker with low fees that align with your trading frequency.

The Role of Leverage in Forex Trading

Leverage allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also lead to significant losses. Make sure you understand the risks before trading with high leverage.

Trading Platforms and Tools Offered by Forex Brokers

Your broker’s platform is where you’ll spend most of your time, so it’s crucial to choose one that offers everything you need, from fast execution to charting tools. Platforms like MetaTrader 4 and 5 are popular, but some brokers also offer proprietary platforms with advanced features.

Conclusion

Choosing the right forex broker is crucial for your trading success, and FintechZoom’s recommendations offer a great starting point. Each of the brokers listed here excels in different areas, so it’s essential to pick one that suits your specific trading needs. Whether it’s low fees, fast execution, or user-friendly platforms, there’s a broker out there for every type of trader.

What is the safest Forex broker?

Answer:

Brokers regulated by top-tier authorities like the FCA, ASIC, or CySEC are generally considered safe.

Are Forex brokers regulated in all countries?

Answer:

No, not all brokers are regulated globally. It’s important to check the regulatory body governing your broker.

How much money do I need to start Forex trading?

Answer:

You can start with as little as $100, but the recommended amount is typically higher for better risk management.

Is Forex trading suitable for beginners?

Answer:

Yes, with the right educational resources and a good broker, beginners can start trading forex successfully.

Can I trade Forex without a broker?

Answer:

No, you need a broker to access the forex market. Brokers provide the platform and tools necessary to execute trades.

Business

How Commercial Lawyers Ensure Seamless Property Transactions for Major Clients

Commercial property transactions are intricate, involving significant sums of money and complex legal frameworks. Have you ever wondered how major clients know these high-stakes deals with such ease? The answer often lies in commercial lawyers’ expertise in smooth transactions. When handling property transactions valued at millions of dollars, clients frequently turn to them for guidance.

Commercial lawyers play a crucial role in ensuring that every detail is meticulously managed, from the initial negotiations to the final contract signing. If you need to know more about property transactions, you can check out lawyer websites like https://www.prestonlaw.com.au/, as they offer tailored legal solutions for their clients. Let’s explore how these experts streamline the process, offering valuable support at every stage.

Understanding Client Needs

Understanding the client’s unique needs and objectives is the first step in successful property dealing. Commercial lawyers take the time to assess what their clients want to achieve, whether it’s acquiring a new property, selling an asset, or entering into a leasing agreement. This understanding forms the foundation of a tailored legal strategy. This client-focused approach is critical to delivering outcomes that meet or exceed expectations.

Navigating Complex Legal Frameworks

A myriad of laws and regulations govern commercial asset dealings. Navigating these legal complexities requires a deep understanding of local and national legislation. Experienced lawyers bring this expertise to the table, ensuring that all aspects of the transaction comply with the relevant legal requirements. By managing these legal intricacies, lawyers help protect clients from potential legal pitfalls and disputes.

Conducting Thorough Due Diligence

Due diligence is a critical component of any transaction. It involves a comprehensive review of the property’s legal status, including title checks, zoning regulations, and existing liens or encumbrances. Commercial lawyers are adept at conducting this due diligence, identifying any issues that could impact the negotiation. It also helps prevent future legal problems that could arise from overlooked details.

Drafting and Negotiating Contracts

One of the most essential roles of a commercial lawyer in property dealings is drafting and negotiating contracts. These documents must clearly outline the terms of the deal, protecting the client’s interests while ensuring that all parties agree. Lawyers use their negotiation skills to secure favourable terms for their clients, whether they are buying, selling, or leasing property. They also ensure that contracts are clear, concise, and accessible from ambiguities that could lead to later disputes.

Ensuring Compliance with Regulatory Requirements

In addition to general legal frameworks, commercial property transactions must also comply with specific regulatory requirements. These may include environmental regulations, building codes, and tax obligations. Lawyers are well-versed in these regulations and ensure that every aspect of the transaction adheres to the necessary standards. Lawyers take proactive steps to address regulatory issues, providing peace of mind for their clients.

Facilitating Smooth Communication Between Parties

Property transactions often involve multiple parties, including buyers, sellers, real estate agents, and financiers. Effective communication between these parties is essential for a smooth transaction. Commercial lawyers act as intermediaries, ensuring that all parties are on the same page and that any issues are addressed promptly. This coordination helps prevent misunderstandings and keeps the transaction on track.

Handling Disputes and Legal Challenges

Even with the best planning, disputes can sometimes arise during property transactions. Commercial lawyers are equipped to handle these challenges, whether it’s a disagreement over contract terms or an issue with the property itself. They provide legal representation and seek to resolve disputes through negotiation, mediation, or litigation if necessary. Their ability to manage conflicts is critical to ensuring a successful outcome.

Commercial lawyers are instrumental in facilitating seamless property transactions for significant clients. Their expertise not only safeguards clients from legal risks but also streamlines transactions, making it easier for clients to achieve their goals confidently. In the high-stakes world of commercial property, having a skilled legal team on your side is essential for success.

-

Marketing4 months ago

Marketing4 months agoUnlocking the Potential of FSI Blogs: A Comprehensive Guide

-

Health6 months ago

Health6 months agoAnxiety: Causes and Solutions

-

Blog6 months ago

Blog6 months agoThe Seating Arrangement Surprise: A Story About Sitting Next to a Scary Yakuza

-

Blog6 months ago

Blog6 months agoUnderstanding Chancerne: Unveiling the Science Behind this Enigmatic Phenomenon

-

Tech6 months ago

Tech6 months agoUnveiling the Wonders of divijos: Revolutionizing Our World

-

Health4 months ago

Health4 months agoDiscover the World of Ztec100.com: Your Ultimate Guide to Tech, Health, and Insurance

-

Business6 months ago

Business6 months agoUnderstanding Trading: Unveiling the Dynamics of Financial Markets

-

Tech5 months ago

Tech5 months agoOprekladač: A Comprehensive Guide to AI Translation Technology