Business

Exploring Binbex: Your Ultimate Guide to Cryptocurrency Trading

In the ever-evolving landscape of cryptocurrency trading platforms, Binbex stands out as a reliable and user-friendly option for both novice and experienced traders. With its intuitive interface, robust security measures, and a plethora of features, Binbex has garnered a loyal following within the crypto community. In this comprehensive guide, we’ll delve into what Binbex offers, how it works, its benefits, and how you can make the most of this platform to enhance your trading experience.

1. Introduction to Binbex

Cryptocurrency trading has become increasingly popular in recent years, with numerous platforms vying for traders’ attention. Among these, Binbex has emerged as a frontrunner, offering a seamless trading experience backed by cutting-edge technology and a commitment to security.

2. What is Binbex?

Binbex is a cryptocurrency exchange platform that allows users to buy, sell, and trade a wide range of digital assets, including Bitcoin, Ethereum, and various altcoins. Launched in [year], Binbex has quickly gained recognition for its user-friendly interface, extensive asset selection, and robust security measures.

3. How Binbex Works

User Interface and Features

Binbex boasts an intuitive and user-friendly interface designed to streamline the trading process. Whether you’re a seasoned trader or just dipping your toes into the world of cryptocurrency, navigating Binbex’s platform is a breeze. From placing trades to monitoring market trends, everything can be done with ease.

Security Measures

Security is paramount in the realm of cryptocurrency trading, and Binbex takes this aspect seriously. The platform employs state-of-the-art security measures, including two-factor authentication (2FA), cold storage for funds, and encryption protocols to safeguard users’ assets and personal information.

4. Benefits of Using Binbex

Convenience

One of the key advantages of Binbex is its convenience. With a user-friendly interface and seamless navigation, trading on Binbex is a hassle-free experience. Whether you’re trading on the go or from the comfort of your home, Binbex provides the tools you need to execute trades with ease.

Security

Security is paramount in the realm of cryptocurrency trading, and Binbex takes this aspect seriously. The platform employs state-of-the-art security measures, including two-factor authentication (2FA), cold storage for funds, and encryption protocols to safeguard users’ assets and personal information.

Accessibility

Binbex offers unparalleled accessibility, allowing users to trade cryptocurrencies anytime, anywhere. Whether you’re a seasoned trader or just getting started, Binbex provides a user-friendly platform that caters to traders of all skill levels.

5. How to Get Started with Binbex

Getting started with Binbex is quick and easy. Simply follow these steps to create an account and start trading:

Registration Process

To register on Binbex, visit the official website and click on the “Sign Up” button. You’ll be prompted to provide some basic information, such as your name, email address, and password. Once you’ve completed the registration process, you’ll receive a confirmation email to verify your account.

Account Verification

After registering, you’ll need to verify your account to access the full range of features on Binbex. This typically involves providing some form of identification, such as a driver’s license or passport, to verify your identity.

Funding Your Account

Once your account is verified, you can fund it with fiat currency or cryptocurrency to start trading. Binbex supports a variety of payment methods, including bank transfers, credit/debit cards, and cryptocurrency deposits.

6. Tips for Successful Trading on Binbex

While Binbex offers a user-friendly platform for trading cryptocurrencies, success in the crypto market requires careful planning and strategy. Here are some tips to help you make the most of your trading experience on Binbex:

Research and Analysis

Before making any trades, take the time to research the market and analyze price trends. Stay informed about the latest news and developments in the cryptocurrency space to make informed trading decisions.

Setting Realistic Goals

Set realistic goals for your trading activity and stick to them. Avoid the temptation to chase quick profits and instead focus on long-term growth and stability.

Risk Management

Cryptocurrency trading can be volatile, so it’s essential to manage your risk effectively. Only invest what you can afford to lose and diversify your portfolio to minimize potential losses.

7. Binbex Fees and Charges

Like any trading platform, Binbex charges fees for its services. These fees may vary depending on the type of transaction and the volume of trades. Be sure to familiarize yourself with Binbex’s fee structure to avoid any surprises.

8. Customer Support and Community

Binbex prides itself on its responsive customer support team and vibrant community of traders. Whether you have a question about a specific trade or need assistance with account-related issues, Binbex’s support team is always on hand to help.

9. Conclusion

In conclusion, Binbex offers a comprehensive and user-friendly platform for cryptocurrency trading. With its intuitive interface, robust security measures, and array of features, Binbex is an excellent choice for both novice and experienced traders alike.

Is Binbex safe to use?

ANSWER:

Yes, Binbex employs state-of-the-art security measures to safeguard users’ assets and personal information.

How do I fund my Binbex account?

ANSWER:

You can fund your Binbex account using fiat currency or cryptocurrency through various payment methods, including bank transfers and credit/debit cards.

Does Binbex charge fees for trading?

ANSWER:

Yes, Binbex charges fees for its services, including trading fees. Be sure to familiarize yourself with Binbex’s fee structure before making any trades.

Can I trade cryptocurrencies on Binbex using a mobile device?

ANSWER:

Yes, Binbex offers a mobile-friendly platform that allows users to trade cryptocurrencies on the go.

Is there a minimum investment requirement to start trading on Binbex?

ANSWER:

No, Binbex does not have a minimum investment requirement, allowing users to start trading with any amount they choose.

Business

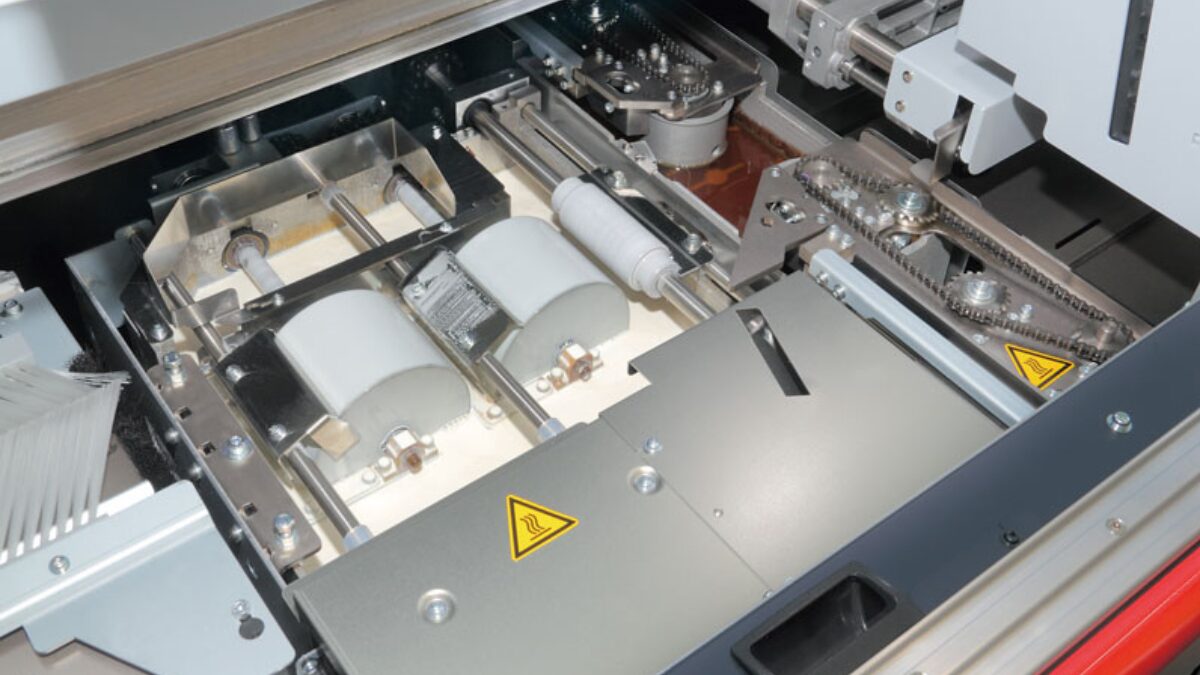

Buying Guide for First-Time Buyers – Perfect Binding Machine

Purchasing the ideal binding machine can feel challenging, especially for first-time buyers. Binding is a widely used method in commercial and digital printing, where hotmelt adhesives are applied to combine loose pages and a cover. The result is a professional-looking book, magazine, or catalogue that is durable and aesthetically pleasing. This method is favoured for its ability to produce high-quality results at a relatively low cost, making it popular among printers of all sizes.

Perfect binding involves several critical steps, including firm clamping of the pages, precise spine preparation, applying adhesive, and nipping the cover into place. With various models and features available, it’s easy to feel overwhelmed. But don’t worry—this guide will walk you through everything you need to know to make an informed decision. Keep reading to learn more!

Key Features to Consider

When shopping for a perfect binding machine, there are several key features you’ll want to consider to ensure you get the right fit for your needs:

Capacity: Consider how many books or pages you’ll be binding regularly. Machines come in different capacities, and selecting one that matches your workload is essential.

Adhesive Type: Hotmelt adhesives are commonly used, but the specific type may vary based on your paper and desired durability. Ensure the machine supports the adhesives suited to your projects.

Speed: The speed of the machine can be a critical factor depending on the volume of work. Some machines are faster and more suited for high-volume operations, while others may be better for smaller, less frequent jobs.

Ease of Use: If you’re new to binding, a user-friendly machine with clear instructions and easy setup can save you much time and frustration.

Durability: Investing in a durable machine can save money in the long run, especially if you plan on using it regularly. Look for machines with robust clamping mechanisms and reliable cover-feeding systems.

Size and Space: Consider the physical space where you’ll place the machine. Some machines are compact, making them ideal for smaller workspaces, while others are larger and require more room.

Top Considerations for First-Time Buyers

As a first-time buyer, you’ll want to assess your specific needs. Here are some questions to help you choose your options:

- Kind of Project: If you’re primarily binding books, you may need a different machine than if you’re focusing on brochures or catalogues.

- Machine Usage: A more affordable, lower-capacity machine might be sufficient for occasional binding needs. However, investing in a more robust machine is advisable for daily or high-volume use.

- Your Budge: These machines range widely in price, so balancing cost with features is essential. While it might be tempting to go for the cheapest option, remember that a higher initial investment in a quality machine can pay off in long-term reliability and fewer repairs.

Common Mistakes to Avoid

It’s easy to make mistakes when purchasing your first paper binding machine. A common pitfall to look for is overlooking maintenance needs: Every machine requires maintenance; some are more demanding than others. Make sure you understand the maintenance requirements before purchasing.

Also, you shouldn’t focus solely on price while making your choice. While budget is important, focusing exclusively on the lowest price can lead to buying a machine that doesn’t meet your needs or lacks durability.

Future of Bookbinding: Key Trends

As you look toward the future of bookbinding, technological advancements continue to redefine the landscape. New developments include automated setups, advanced adhesive technologies, and digital and 3D printing integration. Sustainability is becoming a priority, shifting toward eco-friendly materials and adhesives.

The future of bookbinding machines will likely incorporate AI to enhance efficiency and minimise waste. Staying updated on these trends is crucial for making informed purchases. These innovations will help first-time buyers adapt to the changing landscape of book production.

Choosing a suitable machine is a significant investment, so it’s worth taking the time to make an informed decision. By understanding the basics of perfect binding and considering the key features, you’ll be better equipped to choose a machine that will meet your needs. Remember, your ideal machine should align with the projects you plan to tackle, the volume of work you anticipate, and your available budget.

Business

FintechZoom Best Forex Broker: A Comprehensive Guide to Choosing the Right Forex Broker in 2024

The world of forex trading can seem overwhelming, especially with the sheer number of brokers available today. However, finding the right forex broker is crucial for your trading success. Whether you’re a beginner or an experienced trader, the broker you choose plays a significant role in your ability to execute trades smoothly, access necessary tools, and ultimately make profits. That’s where FintechZoom comes into play. Known for its in-depth reviews and market insights, FintechZoom has become a trusted source for traders looking for the best forex brokers. In this article, we’ll explore the top forex brokers recommended by FintechZoom in 2024 and what makes them stand out.

What Makes a Great Forex Broker?

There are several factors that distinguish an average broker from a great one. When choosing a forex broker, it’s essential to consider the following:

Trustworthiness and Regulation

First and foremost, your broker should be regulated by a reputable financial authority. This ensures that your funds are protected and that the broker operates within a framework of strict standards. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) provide the oversight necessary to ensure that brokers remain transparent and fair.

User-Friendly Platform

A good trading platform is key to executing trades efficiently. Whether it’s MetaTrader 4, MetaTrader 5, or a proprietary platform, ease of use, reliability, and accessibility are essential. Advanced charting tools, real-time data, and a seamless mobile experience can make a significant difference.

Competitive Fees and Spreads

Forex brokers make money through spreads and commissions, so it’s important to find one that offers competitive rates. Low spreads and minimal hidden fees can dramatically reduce your trading costs over time, allowing you to keep more of your profits.

Customer Support and Service

Exceptional customer service is often overlooked but should never be underestimated. A responsive, knowledgeable, and accessible support team can assist with any issues that arise, ensuring your trades go smoothly.

How FintechZoom Evaluates Forex Brokers

FintechZoom has a reputation for providing unbiased and well-researched reviews. But how exactly do they determine which brokers deserve a spot on their coveted “Best Brokers” list?

Criteria Used for Evaluation

FintechZoom assesses brokers based on several criteria, including regulation, platform quality, fees, available assets, and user reviews. Brokers that offer fast execution, low fees, and robust customer support tend to rank higher.

Transparency in Ratings

One of the reasons traders trust FintechZoom’s recommendations is the transparency of their ratings. Their criteria are clearly defined, and they make use of both expert opinions and real user feedback to create a balanced and comprehensive picture of each broker.

Importance of User Reviews and Expert Insights

FintechZoom emphasizes community engagement by incorporating user experiences. This helps create a more accurate evaluation of brokers, allowing for a mix of expert insights and practical user feedback.

Top Forex Brokers According to FintechZoom in 2024

With numerous brokers out there, narrowing down the top choices can be difficult. According to FintechZoom, the following five brokers stood out in 2024.

Broker 1: IG Group

IG Group consistently ranks as one of the top forex brokers due to its extensive market access and stellar reputation. Regulated by top-tier financial authorities like the FCA, IG offers a highly intuitive platform with rich educational resources, making it suitable for traders of all levels.

- Pros: Excellent educational tools, advanced platform, strong regulation.

- Cons: High fees for small trades.

Broker 2: Saxo Bank

Saxo Bank is a premium broker that caters to serious traders. Offering a range of advanced tools and research materials, it’s perfect for those looking to trade a wide array of assets.

- Pros: Wide asset selection, excellent research tools.

- Cons: Higher minimum deposit requirements.

Broker 3: XM

XM is a well-regarded broker known for its competitive pricing and diverse account options. It offers both MetaTrader 4 and MetaTrader 5, giving traders flexibility in their trading tools.

- Pros: Tight spreads, no deposit fees, great for beginners.

- Cons: Limited product offering outside forex.

Broker 4: Pepperstone

Pepperstone has gained a strong reputation for offering ultra-low spreads and fast execution times. Its user-friendly platform and customer service are frequently praised by users, making it ideal for traders focused on efficiency.

- Pros: Fast trade execution, low spreads, excellent for scalping.

- Cons: Limited educational resources.

Broker 5: OANDA

OANDA is one of the most established brokers in the industry, known for its transparency and high-quality service. It offers flexible lot sizes and strong research tools, appealing to both beginners and experienced traders.

- Pros: No minimum deposit, strong analytical tools, flexible lot sizes.

- Cons: Limited asset classes outside of forex.

How to Choose the Right Broker for You

With so many excellent brokers to choose from, how do you know which one is right for you? Start by considering your trading style and risk tolerance. Are you a high-frequency trader? You might need a broker like Pepperstone with fast execution times. Are you just starting? XM or OANDA might be better, thanks to their user-friendly platforms and educational resources.

The Importance of Regulation in Forex Trading

It’s worth reiterating that regulation is critical in choosing a broker. Regulated brokers must follow strict rules that ensure your funds’ safety and transparent operations. Always check the regulatory status of a broker before signing up.

Understanding Forex Trading Fees

The fees charged by brokers can quickly eat into your profits if you’re not careful. Be sure to understand the difference between spreads, commissions, and overnight fees, and choose a broker with low fees that align with your trading frequency.

The Role of Leverage in Forex Trading

Leverage allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also lead to significant losses. Make sure you understand the risks before trading with high leverage.

Trading Platforms and Tools Offered by Forex Brokers

Your broker’s platform is where you’ll spend most of your time, so it’s crucial to choose one that offers everything you need, from fast execution to charting tools. Platforms like MetaTrader 4 and 5 are popular, but some brokers also offer proprietary platforms with advanced features.

Conclusion

Choosing the right forex broker is crucial for your trading success, and FintechZoom’s recommendations offer a great starting point. Each of the brokers listed here excels in different areas, so it’s essential to pick one that suits your specific trading needs. Whether it’s low fees, fast execution, or user-friendly platforms, there’s a broker out there for every type of trader.

What is the safest Forex broker?

Answer:

Brokers regulated by top-tier authorities like the FCA, ASIC, or CySEC are generally considered safe.

Are Forex brokers regulated in all countries?

Answer:

No, not all brokers are regulated globally. It’s important to check the regulatory body governing your broker.

How much money do I need to start Forex trading?

Answer:

You can start with as little as $100, but the recommended amount is typically higher for better risk management.

Is Forex trading suitable for beginners?

Answer:

Yes, with the right educational resources and a good broker, beginners can start trading forex successfully.

Can I trade Forex without a broker?

Answer:

No, you need a broker to access the forex market. Brokers provide the platform and tools necessary to execute trades.

Business

How Commercial Lawyers Ensure Seamless Property Transactions for Major Clients

Commercial property transactions are intricate, involving significant sums of money and complex legal frameworks. Have you ever wondered how major clients know these high-stakes deals with such ease? The answer often lies in commercial lawyers’ expertise in smooth transactions. When handling property transactions valued at millions of dollars, clients frequently turn to them for guidance.

Commercial lawyers play a crucial role in ensuring that every detail is meticulously managed, from the initial negotiations to the final contract signing. If you need to know more about property transactions, you can check out lawyer websites like https://www.prestonlaw.com.au/, as they offer tailored legal solutions for their clients. Let’s explore how these experts streamline the process, offering valuable support at every stage.

Understanding Client Needs

Understanding the client’s unique needs and objectives is the first step in successful property dealing. Commercial lawyers take the time to assess what their clients want to achieve, whether it’s acquiring a new property, selling an asset, or entering into a leasing agreement. This understanding forms the foundation of a tailored legal strategy. This client-focused approach is critical to delivering outcomes that meet or exceed expectations.

Navigating Complex Legal Frameworks

A myriad of laws and regulations govern commercial asset dealings. Navigating these legal complexities requires a deep understanding of local and national legislation. Experienced lawyers bring this expertise to the table, ensuring that all aspects of the transaction comply with the relevant legal requirements. By managing these legal intricacies, lawyers help protect clients from potential legal pitfalls and disputes.

Conducting Thorough Due Diligence

Due diligence is a critical component of any transaction. It involves a comprehensive review of the property’s legal status, including title checks, zoning regulations, and existing liens or encumbrances. Commercial lawyers are adept at conducting this due diligence, identifying any issues that could impact the negotiation. It also helps prevent future legal problems that could arise from overlooked details.

Drafting and Negotiating Contracts

One of the most essential roles of a commercial lawyer in property dealings is drafting and negotiating contracts. These documents must clearly outline the terms of the deal, protecting the client’s interests while ensuring that all parties agree. Lawyers use their negotiation skills to secure favourable terms for their clients, whether they are buying, selling, or leasing property. They also ensure that contracts are clear, concise, and accessible from ambiguities that could lead to later disputes.

Ensuring Compliance with Regulatory Requirements

In addition to general legal frameworks, commercial property transactions must also comply with specific regulatory requirements. These may include environmental regulations, building codes, and tax obligations. Lawyers are well-versed in these regulations and ensure that every aspect of the transaction adheres to the necessary standards. Lawyers take proactive steps to address regulatory issues, providing peace of mind for their clients.

Facilitating Smooth Communication Between Parties

Property transactions often involve multiple parties, including buyers, sellers, real estate agents, and financiers. Effective communication between these parties is essential for a smooth transaction. Commercial lawyers act as intermediaries, ensuring that all parties are on the same page and that any issues are addressed promptly. This coordination helps prevent misunderstandings and keeps the transaction on track.

Handling Disputes and Legal Challenges

Even with the best planning, disputes can sometimes arise during property transactions. Commercial lawyers are equipped to handle these challenges, whether it’s a disagreement over contract terms or an issue with the property itself. They provide legal representation and seek to resolve disputes through negotiation, mediation, or litigation if necessary. Their ability to manage conflicts is critical to ensuring a successful outcome.

Commercial lawyers are instrumental in facilitating seamless property transactions for significant clients. Their expertise not only safeguards clients from legal risks but also streamlines transactions, making it easier for clients to achieve their goals confidently. In the high-stakes world of commercial property, having a skilled legal team on your side is essential for success.

-

Marketing4 months ago

Marketing4 months agoUnlocking the Potential of FSI Blogs: A Comprehensive Guide

-

Health6 months ago

Health6 months agoAnxiety: Causes and Solutions

-

Blog6 months ago

Blog6 months agoThe Seating Arrangement Surprise: A Story About Sitting Next to a Scary Yakuza

-

Blog6 months ago

Blog6 months agoUnderstanding Chancerne: Unveiling the Science Behind this Enigmatic Phenomenon

-

Tech6 months ago

Tech6 months agoUnveiling the Wonders of divijos: Revolutionizing Our World

-

Health4 months ago

Health4 months agoDiscover the World of Ztec100.com: Your Ultimate Guide to Tech, Health, and Insurance

-

Business6 months ago

Business6 months agoUnderstanding Trading: Unveiling the Dynamics of Financial Markets

-

Tech5 months ago

Tech5 months agoOprekladač: A Comprehensive Guide to AI Translation Technology