Business

Boost Business Success with LeoMorg Analytics

In the realm of data analysis, the ability to transform raw data into actionable insights is more crucial than ever. As businesses become increasingly data-driven, the demand for advanced tools that can simplify and enhance the data analysis process has grown exponentially. Enter LeoMorg—a cutting-edge platform designed to meet the evolving needs of data analysts. In this blog post, we will explore how LeoMorg is revolutionizing the way data is analyzed and transformed into valuable insights.

Introduction to LeoMorg: An Overview of the Platform

LeoMorg is not just another data analysis tool; it is an all-encompassing platform tailored to the needs of modern data analysts. It combines powerful algorithms, intuitive design, and advanced features to provide a seamless experience from data ingestion to insight generation.

Key Features of LeoMorg

Data Integration: LeoMorg supports a wide range of data sources, allowing analysts to import data effortlessly from databases, cloud storage, and even real-time streaming sources.

Advanced Analytics: The platform offers a suite of analytical tools, including statistical analysis, machine learning models, and predictive analytics, to uncover hidden patterns and trends in data.

Visualization: With a robust set of visualization options, LeoMorg enables analysts to create compelling charts, graphs, and dashboards that make complex data easily understandable.

Collaboration: LeoMorg supports collaborative workflows, allowing multiple users to work on the same project simultaneously, share insights, and provide feedback in real-time.

Scalability: Designed to handle large datasets, LeoMorg ensures that performance remains optimal even as data volume grows.

Understanding the Needs of Data Analysts in Today’s Business Environment

Data analysts play a pivotal role in driving business decisions by interpreting complex data sets. However, the traditional data analysis process is often fraught with challenges:

Common Challenges Faced by Data Analysts

Data Silos: Data is often scattered across various systems and formats, making it difficult to consolidate and analyze.

Time-Consuming Processes: Data cleaning, preparation, and validation can consume a significant amount of time, leaving less time for actual analysis.

Complexity: Advanced analytical techniques often require specialized knowledge and skills, making them inaccessible to many analysts.

Communication Barriers: Translating technical findings into actionable business insights that stakeholders can understand is a constant challenge.

Scalability Issues: As data volumes grow, maintaining performance and accuracy becomes increasingly difficult.

How LeoMorg Addresses These Needs

LeoMorg is designed with these challenges in mind, offering solutions that streamline and enhance the data analysis process:

Unified Data Platform: By integrating various data sources into a single platform, LeoMorg eliminates data silos and makes it easier to access and analyze data.

Automated Data Preparation: Advanced algorithms automate data cleaning, preparation, and validation, significantly reducing the time required for these tasks.

User-Friendly Interface: LeoMorg’s intuitive design makes advanced analytical techniques accessible to analysts of all skill levels.

Data Storytelling: The platform’s visualization tools enable analysts to create clear and compelling narratives that communicate insights effectively.

High Performance: LeoMorg is built to scale, ensuring that performance remains consistent even as data volumes increase.

How LeoMorg Transforms Raw Data into Actionable Insights

The core value of LeoMorg lies in its ability to transform raw data into actionable insights. Let’s take a closer look at how this transformation occurs:

Data Ingestion and Integration

The first step in the data analysis process is ingesting and integrating data from various sources. LeoMorg supports a wide range of data connectors, including:

Databases: SQL, NoSQL, and NewSQL databases

Cloud Storage: AWS S3, Google Cloud Storage, Microsoft Azure

Real-Time Streaming: Apache Kafka, AWS Kinesis, Google Pub/Sub

APIs: RESTful APIs, Webhooks

By providing seamless integration with these data sources, LeoMorg ensures that analysts can access all the data they need without any hassle.

Data Cleaning and Preparation

Once the data is ingested, it needs to be cleaned and prepared for analysis. This involves tasks such as:

Removing Duplicates: Identifying and removing duplicate records to ensure data accuracy

Handling Missing Values: Imputing or removing missing values to maintain data integrity

Data Transformation: Converting data into a consistent format and structure

LeoMorg automates these tasks using advanced algorithms, significantly reducing the time and effort required for data preparation.

Advanced Analytics

With the data cleaned and prepared, analysts can move on to the actual analysis. LeoMorg offers a comprehensive suite of analytical tools, including:

Descriptive Analytics: Summarizing historical data to understand past trends and patterns

Diagnostic Analytics: Identifying the root causes of observed phenomena

Predictive Analytics: Using machine learning models to forecast future outcomes based on historical data

Prescriptive Analytics: Providing recommendations for actions based on predictive insights

These tools enable analysts to uncover valuable insights that drive informed decision-making.

Visualization and Reporting

The final step in the data analysis process is visualizing and reporting the insights. LeoMorg provides a wide range of visualization options, including:

Charts and Graphs: Bar charts, line charts, pie charts, scatter plots, and more

Dashboards: Interactive dashboards that provide a comprehensive view of key metrics and KPIs

Storyboards: Combining visualizations with narrative text to create compelling data stories

These visualization tools make it easy for analysts to communicate their findings to stakeholders in a clear and engaging manner.

Real-World Examples of LeoMorg in Use by Leading Data Analysts

To illustrate the power and versatility of LeoMorg, let’s look at some real-world examples of how leading data analysts are using the platform to drive business success:

Example 1: Retail Industry

A major retail chain used LeoMorg to analyze customer purchasing behavior and optimize their inventory management. By integrating data from their point-of-sale systems, online store, and customer loyalty program, they were able to:

Identify Trends: Detect emerging trends in customer preferences and adjust their product offerings accordingly

Optimize Inventory: Predict demand for different products and optimize inventory levels to reduce stockouts and overstock situations

Enhance Customer Experience: Personalize marketing campaigns and promotions based on customer preferences and behavior

As a result, the retail chain saw a significant increase in sales and customer satisfaction.

Example 2: Healthcare Industry

A leading healthcare provider used LeoMorg to improve patient outcomes and operational efficiency. By analyzing data from electronic health records (EHRs), patient surveys, and operational metrics, they were able to:

Predict Patient Outcomes: Use predictive analytics to identify patients at risk of complications and intervene early

Optimize Resource Allocation: Allocate staff and resources more efficiently based on patient demand and operational metrics

Improve Patient Satisfaction: Identify areas for improvement in patient care and implement targeted initiatives to enhance the patient experience

As a result, the healthcare provider saw improved patient outcomes and increased operational efficiency.

Example 3: Financial Services Industry

A major financial services firm used LeoMorg to enhance their risk management and compliance efforts. By integrating data from their transaction systems, customer profiles, and regulatory reports, they were able to:

Identify Risk Factors: Detect potential risks and vulnerabilities in their operations and take proactive measures to mitigate them

Ensure Compliance: Monitor compliance with regulatory requirements and identify areas for improvement

Enhance Decision-Making: Use data-driven insights to make informed decisions and optimize their risk management strategies

As a result, the financial services firm saw reduced risk exposure and improved regulatory compliance.

The Future of Data Analysis with LeoMorg: Upcoming Features and Enhancements

LeoMorg is continuously evolving to meet the changing needs of data analysts. Here are some of the upcoming features and enhancements that will further enhance the platform’s capabilities:

Enhanced Machine Learning

LeoMorg is integrating more advanced machine learning models to provide even more accurate and insightful predictions. This includes support for deep learning and neural networks, which will enable analysts to tackle more complex and nuanced problems.

Natural Language Processing (NLP)

The platform is also incorporating NLP capabilities to enable analysts to interact with their data using natural language queries. This will make it easier for analysts to explore their data and uncover insights without needing to write complex queries.

Automated Insights

LeoMorg is developing automated insight generation features that will automatically identify and highlight key insights from the data. This will save analysts time and effort, allowing them to focus on interpreting and acting on the insights.

Enhanced Collaboration

The platform is enhancing its collaboration features to make it even easier for teams to work together on data analysis projects. This includes support for real-time collaboration, version control, and workflow management.

Integration with External Tools

LeoMorg is expanding its integration capabilities to support a wider range of external tools and platforms. This will enable analysts to seamlessly incorporate LeoMorg into their existing workflows and leverage the best tools for their specific needs.

You May Also Like: Unlocking the Potential of Hqpotner: A Comprehensive Guide

Conclusion:

In conclusion, LeoMorg is transforming the way data analysts work by providing a comprehensive and intuitive platform for data analysis. By addressing the common challenges faced by data analysts and offering advanced analytical capabilities, LeoMorg empowers analysts to uncover valuable insights and drive business success.

As the platform continues to evolve and incorporate new features, its impact on the field of data analysis will only grow. Whether you’re a seasoned data analyst or just starting your journey, LeoMorg offers the tools and capabilities you need to turn raw data into actionable insights.

Discover the power of LeoMorg for yourself and see how it can revolutionize your data analysis workflow. Sign up today and start transforming your data into insights.

Frequently Asked Questions

What is LeoMorg?

LeoMorg is a comprehensive data analysis platform designed to empower data analysts by providing advanced analytical capabilities, machine learning models, and intuitive tools to explore, analyze, and uncover valuable insights from their data.

How can LeoMorg benefit my business?

LeoMorg can benefit your business by enabling you to make data-driven decisions, optimize operations, and enhance customer experiences. By providing insights through advanced analytics and machine learning, LeoMorg helps businesses across various industries, including retail, healthcare, and financial services, to improve efficiency and drive success.

What industries can benefit from LeoMorg?

LeoMorg is versatile and can be utilized across multiple industries. Notable examples include retail, healthcare, and financial services. In these industries, LeoMorg has been used to optimize inventory, improve patient outcomes, enhance risk management, and ensure regulatory compliance, among other applications.

What upcoming features are planned for LeoMorg?

LeoMorg is continuously evolving, with upcoming features including enhanced machine learning models, natural language processing (NLP) capabilities, automated insight generation, improved collaboration tools, and expanded integration with external tools and platforms. These enhancements aim to provide even greater value and ease of use for data analysts.

How can I get started with LeoMorg?

Getting started with LeoMorg is simple. You can sign up on their website to begin exploring the platform’s capabilities. LeoMorg offers various resources, including documentation, tutorials, and customer support, to help new users make the most of the platform and transform their data analysis workflows.

Business

Buying Guide for First-Time Buyers – Perfect Binding Machine

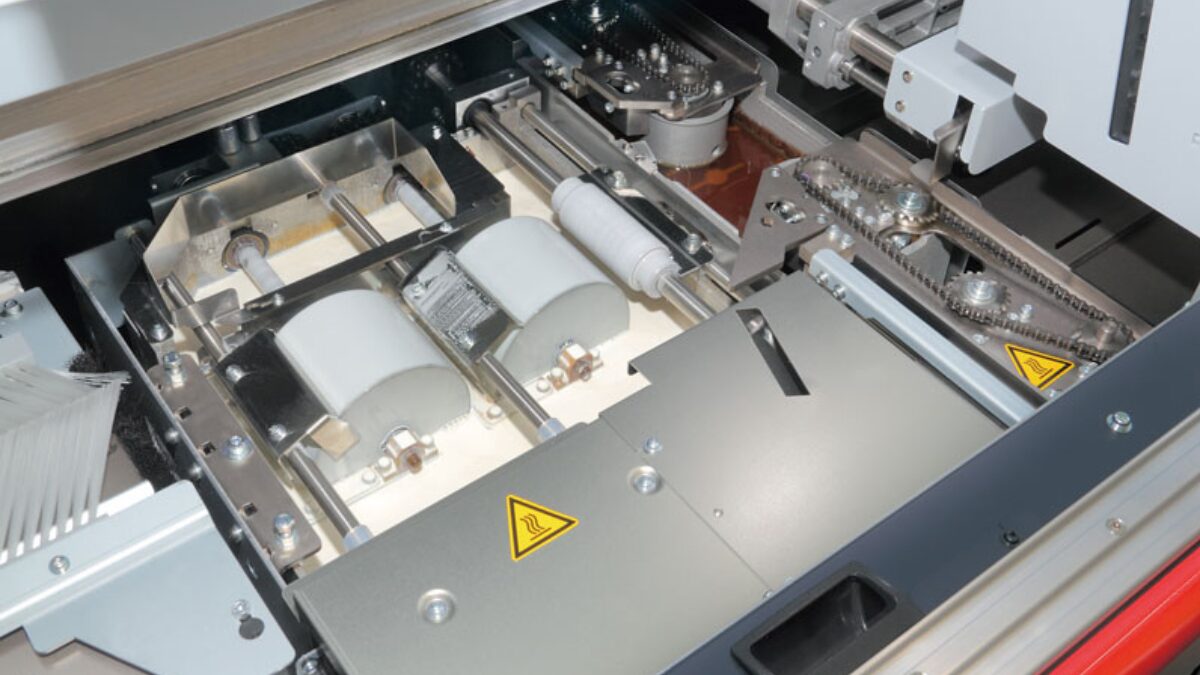

Purchasing the ideal binding machine can feel challenging, especially for first-time buyers. Binding is a widely used method in commercial and digital printing, where hotmelt adhesives are applied to combine loose pages and a cover. The result is a professional-looking book, magazine, or catalogue that is durable and aesthetically pleasing. This method is favoured for its ability to produce high-quality results at a relatively low cost, making it popular among printers of all sizes.

Perfect binding involves several critical steps, including firm clamping of the pages, precise spine preparation, applying adhesive, and nipping the cover into place. With various models and features available, it’s easy to feel overwhelmed. But don’t worry—this guide will walk you through everything you need to know to make an informed decision. Keep reading to learn more!

Key Features to Consider

When shopping for a perfect binding machine, there are several key features you’ll want to consider to ensure you get the right fit for your needs:

Capacity: Consider how many books or pages you’ll be binding regularly. Machines come in different capacities, and selecting one that matches your workload is essential.

Adhesive Type: Hotmelt adhesives are commonly used, but the specific type may vary based on your paper and desired durability. Ensure the machine supports the adhesives suited to your projects.

Speed: The speed of the machine can be a critical factor depending on the volume of work. Some machines are faster and more suited for high-volume operations, while others may be better for smaller, less frequent jobs.

Ease of Use: If you’re new to binding, a user-friendly machine with clear instructions and easy setup can save you much time and frustration.

Durability: Investing in a durable machine can save money in the long run, especially if you plan on using it regularly. Look for machines with robust clamping mechanisms and reliable cover-feeding systems.

Size and Space: Consider the physical space where you’ll place the machine. Some machines are compact, making them ideal for smaller workspaces, while others are larger and require more room.

Top Considerations for First-Time Buyers

As a first-time buyer, you’ll want to assess your specific needs. Here are some questions to help you choose your options:

- Kind of Project: If you’re primarily binding books, you may need a different machine than if you’re focusing on brochures or catalogues.

- Machine Usage: A more affordable, lower-capacity machine might be sufficient for occasional binding needs. However, investing in a more robust machine is advisable for daily or high-volume use.

- Your Budge: These machines range widely in price, so balancing cost with features is essential. While it might be tempting to go for the cheapest option, remember that a higher initial investment in a quality machine can pay off in long-term reliability and fewer repairs.

Common Mistakes to Avoid

It’s easy to make mistakes when purchasing your first paper binding machine. A common pitfall to look for is overlooking maintenance needs: Every machine requires maintenance; some are more demanding than others. Make sure you understand the maintenance requirements before purchasing.

Also, you shouldn’t focus solely on price while making your choice. While budget is important, focusing exclusively on the lowest price can lead to buying a machine that doesn’t meet your needs or lacks durability.

Future of Bookbinding: Key Trends

As you look toward the future of bookbinding, technological advancements continue to redefine the landscape. New developments include automated setups, advanced adhesive technologies, and digital and 3D printing integration. Sustainability is becoming a priority, shifting toward eco-friendly materials and adhesives.

The future of bookbinding machines will likely incorporate AI to enhance efficiency and minimise waste. Staying updated on these trends is crucial for making informed purchases. These innovations will help first-time buyers adapt to the changing landscape of book production.

Choosing a suitable machine is a significant investment, so it’s worth taking the time to make an informed decision. By understanding the basics of perfect binding and considering the key features, you’ll be better equipped to choose a machine that will meet your needs. Remember, your ideal machine should align with the projects you plan to tackle, the volume of work you anticipate, and your available budget.

Business

FintechZoom Best Forex Broker: A Comprehensive Guide to Choosing the Right Forex Broker in 2024

The world of forex trading can seem overwhelming, especially with the sheer number of brokers available today. However, finding the right forex broker is crucial for your trading success. Whether you’re a beginner or an experienced trader, the broker you choose plays a significant role in your ability to execute trades smoothly, access necessary tools, and ultimately make profits. That’s where FintechZoom comes into play. Known for its in-depth reviews and market insights, FintechZoom has become a trusted source for traders looking for the best forex brokers. In this article, we’ll explore the top forex brokers recommended by FintechZoom in 2024 and what makes them stand out.

What Makes a Great Forex Broker?

There are several factors that distinguish an average broker from a great one. When choosing a forex broker, it’s essential to consider the following:

Trustworthiness and Regulation

First and foremost, your broker should be regulated by a reputable financial authority. This ensures that your funds are protected and that the broker operates within a framework of strict standards. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) provide the oversight necessary to ensure that brokers remain transparent and fair.

User-Friendly Platform

A good trading platform is key to executing trades efficiently. Whether it’s MetaTrader 4, MetaTrader 5, or a proprietary platform, ease of use, reliability, and accessibility are essential. Advanced charting tools, real-time data, and a seamless mobile experience can make a significant difference.

Competitive Fees and Spreads

Forex brokers make money through spreads and commissions, so it’s important to find one that offers competitive rates. Low spreads and minimal hidden fees can dramatically reduce your trading costs over time, allowing you to keep more of your profits.

Customer Support and Service

Exceptional customer service is often overlooked but should never be underestimated. A responsive, knowledgeable, and accessible support team can assist with any issues that arise, ensuring your trades go smoothly.

How FintechZoom Evaluates Forex Brokers

FintechZoom has a reputation for providing unbiased and well-researched reviews. But how exactly do they determine which brokers deserve a spot on their coveted “Best Brokers” list?

Criteria Used for Evaluation

FintechZoom assesses brokers based on several criteria, including regulation, platform quality, fees, available assets, and user reviews. Brokers that offer fast execution, low fees, and robust customer support tend to rank higher.

Transparency in Ratings

One of the reasons traders trust FintechZoom’s recommendations is the transparency of their ratings. Their criteria are clearly defined, and they make use of both expert opinions and real user feedback to create a balanced and comprehensive picture of each broker.

Importance of User Reviews and Expert Insights

FintechZoom emphasizes community engagement by incorporating user experiences. This helps create a more accurate evaluation of brokers, allowing for a mix of expert insights and practical user feedback.

Top Forex Brokers According to FintechZoom in 2024

With numerous brokers out there, narrowing down the top choices can be difficult. According to FintechZoom, the following five brokers stood out in 2024.

Broker 1: IG Group

IG Group consistently ranks as one of the top forex brokers due to its extensive market access and stellar reputation. Regulated by top-tier financial authorities like the FCA, IG offers a highly intuitive platform with rich educational resources, making it suitable for traders of all levels.

- Pros: Excellent educational tools, advanced platform, strong regulation.

- Cons: High fees for small trades.

Broker 2: Saxo Bank

Saxo Bank is a premium broker that caters to serious traders. Offering a range of advanced tools and research materials, it’s perfect for those looking to trade a wide array of assets.

- Pros: Wide asset selection, excellent research tools.

- Cons: Higher minimum deposit requirements.

Broker 3: XM

XM is a well-regarded broker known for its competitive pricing and diverse account options. It offers both MetaTrader 4 and MetaTrader 5, giving traders flexibility in their trading tools.

- Pros: Tight spreads, no deposit fees, great for beginners.

- Cons: Limited product offering outside forex.

Broker 4: Pepperstone

Pepperstone has gained a strong reputation for offering ultra-low spreads and fast execution times. Its user-friendly platform and customer service are frequently praised by users, making it ideal for traders focused on efficiency.

- Pros: Fast trade execution, low spreads, excellent for scalping.

- Cons: Limited educational resources.

Broker 5: OANDA

OANDA is one of the most established brokers in the industry, known for its transparency and high-quality service. It offers flexible lot sizes and strong research tools, appealing to both beginners and experienced traders.

- Pros: No minimum deposit, strong analytical tools, flexible lot sizes.

- Cons: Limited asset classes outside of forex.

How to Choose the Right Broker for You

With so many excellent brokers to choose from, how do you know which one is right for you? Start by considering your trading style and risk tolerance. Are you a high-frequency trader? You might need a broker like Pepperstone with fast execution times. Are you just starting? XM or OANDA might be better, thanks to their user-friendly platforms and educational resources.

The Importance of Regulation in Forex Trading

It’s worth reiterating that regulation is critical in choosing a broker. Regulated brokers must follow strict rules that ensure your funds’ safety and transparent operations. Always check the regulatory status of a broker before signing up.

Understanding Forex Trading Fees

The fees charged by brokers can quickly eat into your profits if you’re not careful. Be sure to understand the difference between spreads, commissions, and overnight fees, and choose a broker with low fees that align with your trading frequency.

The Role of Leverage in Forex Trading

Leverage allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also lead to significant losses. Make sure you understand the risks before trading with high leverage.

Trading Platforms and Tools Offered by Forex Brokers

Your broker’s platform is where you’ll spend most of your time, so it’s crucial to choose one that offers everything you need, from fast execution to charting tools. Platforms like MetaTrader 4 and 5 are popular, but some brokers also offer proprietary platforms with advanced features.

Conclusion

Choosing the right forex broker is crucial for your trading success, and FintechZoom’s recommendations offer a great starting point. Each of the brokers listed here excels in different areas, so it’s essential to pick one that suits your specific trading needs. Whether it’s low fees, fast execution, or user-friendly platforms, there’s a broker out there for every type of trader.

What is the safest Forex broker?

Answer:

Brokers regulated by top-tier authorities like the FCA, ASIC, or CySEC are generally considered safe.

Are Forex brokers regulated in all countries?

Answer:

No, not all brokers are regulated globally. It’s important to check the regulatory body governing your broker.

How much money do I need to start Forex trading?

Answer:

You can start with as little as $100, but the recommended amount is typically higher for better risk management.

Is Forex trading suitable for beginners?

Answer:

Yes, with the right educational resources and a good broker, beginners can start trading forex successfully.

Can I trade Forex without a broker?

Answer:

No, you need a broker to access the forex market. Brokers provide the platform and tools necessary to execute trades.

Business

How Commercial Lawyers Ensure Seamless Property Transactions for Major Clients

Commercial property transactions are intricate, involving significant sums of money and complex legal frameworks. Have you ever wondered how major clients know these high-stakes deals with such ease? The answer often lies in commercial lawyers’ expertise in smooth transactions. When handling property transactions valued at millions of dollars, clients frequently turn to them for guidance.

Commercial lawyers play a crucial role in ensuring that every detail is meticulously managed, from the initial negotiations to the final contract signing. If you need to know more about property transactions, you can check out lawyer websites like https://www.prestonlaw.com.au/, as they offer tailored legal solutions for their clients. Let’s explore how these experts streamline the process, offering valuable support at every stage.

Understanding Client Needs

Understanding the client’s unique needs and objectives is the first step in successful property dealing. Commercial lawyers take the time to assess what their clients want to achieve, whether it’s acquiring a new property, selling an asset, or entering into a leasing agreement. This understanding forms the foundation of a tailored legal strategy. This client-focused approach is critical to delivering outcomes that meet or exceed expectations.

Navigating Complex Legal Frameworks

A myriad of laws and regulations govern commercial asset dealings. Navigating these legal complexities requires a deep understanding of local and national legislation. Experienced lawyers bring this expertise to the table, ensuring that all aspects of the transaction comply with the relevant legal requirements. By managing these legal intricacies, lawyers help protect clients from potential legal pitfalls and disputes.

Conducting Thorough Due Diligence

Due diligence is a critical component of any transaction. It involves a comprehensive review of the property’s legal status, including title checks, zoning regulations, and existing liens or encumbrances. Commercial lawyers are adept at conducting this due diligence, identifying any issues that could impact the negotiation. It also helps prevent future legal problems that could arise from overlooked details.

Drafting and Negotiating Contracts

One of the most essential roles of a commercial lawyer in property dealings is drafting and negotiating contracts. These documents must clearly outline the terms of the deal, protecting the client’s interests while ensuring that all parties agree. Lawyers use their negotiation skills to secure favourable terms for their clients, whether they are buying, selling, or leasing property. They also ensure that contracts are clear, concise, and accessible from ambiguities that could lead to later disputes.

Ensuring Compliance with Regulatory Requirements

In addition to general legal frameworks, commercial property transactions must also comply with specific regulatory requirements. These may include environmental regulations, building codes, and tax obligations. Lawyers are well-versed in these regulations and ensure that every aspect of the transaction adheres to the necessary standards. Lawyers take proactive steps to address regulatory issues, providing peace of mind for their clients.

Facilitating Smooth Communication Between Parties

Property transactions often involve multiple parties, including buyers, sellers, real estate agents, and financiers. Effective communication between these parties is essential for a smooth transaction. Commercial lawyers act as intermediaries, ensuring that all parties are on the same page and that any issues are addressed promptly. This coordination helps prevent misunderstandings and keeps the transaction on track.

Handling Disputes and Legal Challenges

Even with the best planning, disputes can sometimes arise during property transactions. Commercial lawyers are equipped to handle these challenges, whether it’s a disagreement over contract terms or an issue with the property itself. They provide legal representation and seek to resolve disputes through negotiation, mediation, or litigation if necessary. Their ability to manage conflicts is critical to ensuring a successful outcome.

Commercial lawyers are instrumental in facilitating seamless property transactions for significant clients. Their expertise not only safeguards clients from legal risks but also streamlines transactions, making it easier for clients to achieve their goals confidently. In the high-stakes world of commercial property, having a skilled legal team on your side is essential for success.

-

Marketing4 months ago

Marketing4 months agoUnlocking the Potential of FSI Blogs: A Comprehensive Guide

-

Health6 months ago

Health6 months agoAnxiety: Causes and Solutions

-

Blog6 months ago

Blog6 months agoThe Seating Arrangement Surprise: A Story About Sitting Next to a Scary Yakuza

-

Blog6 months ago

Blog6 months agoUnderstanding Chancerne: Unveiling the Science Behind this Enigmatic Phenomenon

-

Tech6 months ago

Tech6 months agoUnveiling the Wonders of divijos: Revolutionizing Our World

-

Health4 months ago

Health4 months agoDiscover the World of Ztec100.com: Your Ultimate Guide to Tech, Health, and Insurance

-

Business6 months ago

Business6 months agoUnderstanding Trading: Unveiling the Dynamics of Financial Markets

-

Tech5 months ago

Tech5 months agoOprekladač: A Comprehensive Guide to AI Translation Technology